“We help anyone in the United States who wants to sell their good or service overseas through short, medium, and long-term financing tools for international buyers. It’s usually medium term and long term. We provide foreign buyers with the ability to purchase U.S. goods and services. So we’re debt financiers to buyers of American goods… Continue reading Financial Support For Exporting, Trade – Judith Pryor, Export Import Bank of U.S.

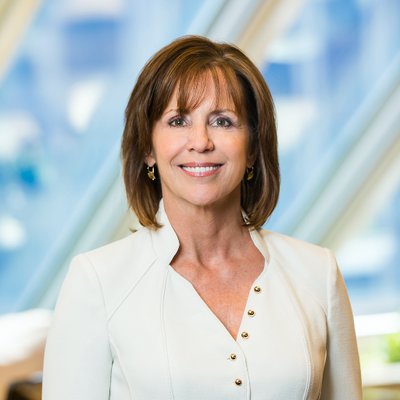

Financial Support For Exporting, Trade – Judith Pryor, Export Import Bank of U.S.